- March 25, 2025

- Updated 2:22 am

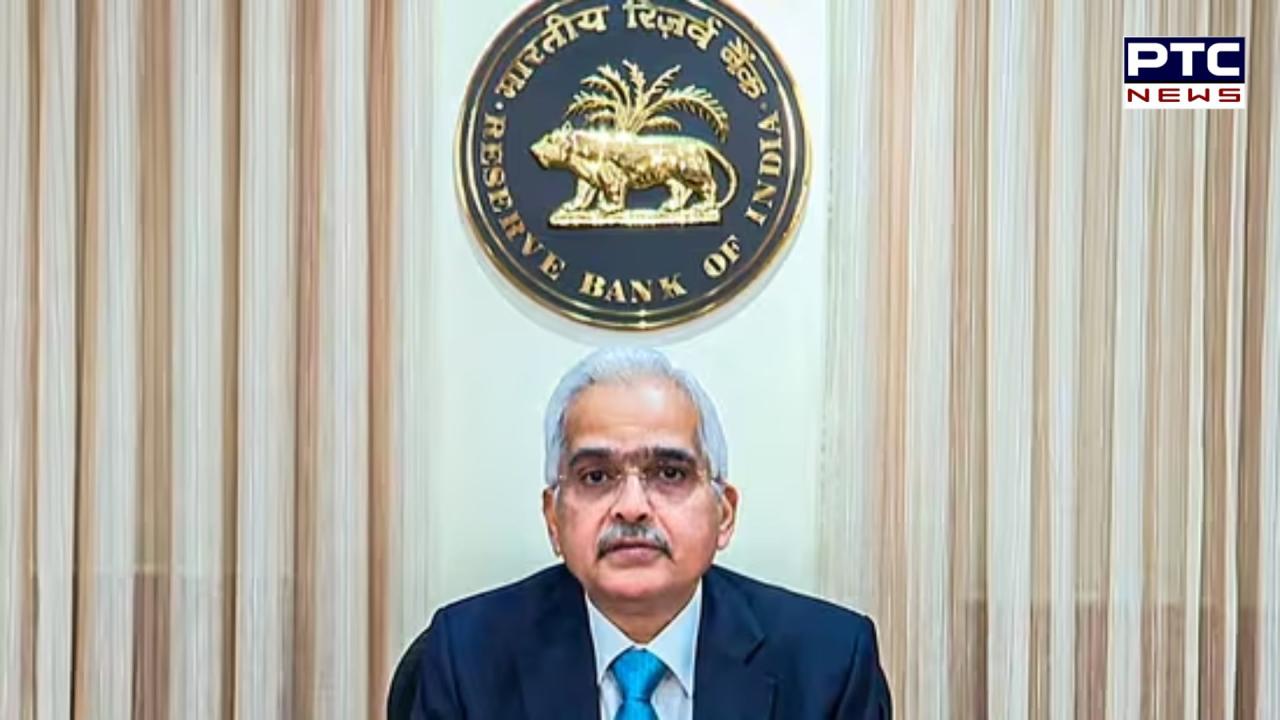

RBI Monetary Policy: Will interest rates shift today? Experts weigh in

PTC News Desk: The Reserve Bank of India (RBI) is set to conclude its three-day Monetary Policy Committee (MPC) meeting today, with RBI Governor Shaktikanta Das poised to announce the central bank’s highly anticipated decision on policy rates. This meeting, which commenced on October 7, has captured widespread attention due to the delicate balance the RBI must maintain between inflation control and economic growth.

The central bank has kept the key repo rate steady at 6.50 per cent for nine consecutive meetings, signaling a cautious approach in navigating the post-pandemic economic landscape. The key question now is whether the RBI will continue to hold rates or signal a shift in its monetary policy stance.

Inflationary Pressures and Global Concerns

Several critical factors are under the MPC’s consideration, with inflationary pressures, particularly rising food prices, standing out as a key concern. Although India’s headline Consumer Price Index (CPI) inflation dropped to 3.65% in August—comfortably within the RBI’s target range of 2-6%—food inflation remains significantly elevated at 5.65%. This figure exceeds the central bank’s medium-term target of 4%, reflecting the stubbornness of price increases in essential food items.

In addition to domestic inflation, rising global crude oil prices, driven by geopolitical tensions in West Asia, have raised concerns about imported inflation. The combination of these factors is making it increasingly difficult for the RBI to take an aggressive stance on interest rate adjustments.

RBI’s Cautious Approach

Despite these challenges, the RBI has so far maintained a status quo on interest rates, prioritizing economic stability and recovery from the pandemic. The central bank has focused on providing an environment conducive to growth while keeping inflation in check, leading to its cautious stance over the past several months.

Today’s announcement, however, is eagerly awaited to see if the RBI will adjust its policy given the complex global and domestic economic landscape. External pressures, such as volatile global markets, oil price fluctuations, and inflation uncertainties, are weighing heavily on the central bank’s decision-making process.

Also Read: Historic first-ever Durga puja celebrations at New York’s Times Square captivate the internet

Economists’ Outlook

Several economists believe that the RBI is unlikely to alter its policy stance before December. M Govind Rao, a member of the Fourteenth Finance Commission and former Director of the National Institute of Public Finance and Policy, said, “With the focus on taming headline inflation, the RBI is likely to hold the rates, although core inflation remains within the limit. It is possible the RBI may shift to a more neutral stance.”

Another prominent economist, Manoranjan Sharma, Chief Economist at Infomerics Ratings, echoed a similar sentiment. He noted, “In this overarching macroeconomic setting of heightened geopolitical tensions, core inflation inching upwards, oil price volatility, and high food inflation, we anticipate a change in the RBI’s policy stance from ‘withdrawal of accommodation’ to ‘neutral’ at its forthcoming MPC meeting on October 9, 2024. However, we do not see any rate action coming, and the benchmark interest rates may not undergo any change.”

The Road Ahead

Governor Das is expected to provide detailed insights into the MPC’s decision, shedding light on how the central bank plans to manage inflation risks while promoting economic growth. The outcome of this meeting will not only set the tone for the future trajectory of interest rates but also influence broader economic policies in the coming months.

As the RBI continues to navigate a complex macroeconomic environment marked by inflation, geopolitical tensions, and global market uncertainties, today’s decision will be pivotal in determining how India’s monetary policy evolves in the near future.

Also Read: Hooda-centric strategy backfires: Congress stumbles in Haryana elections

Recent Posts

- Crown of goddess Kali, gifted by PM Modi, stolen from temple in Bangladesh

- Hezbollah leader survives assassination attempt amid Israeli strikes that kill 22 in Beirut

- ਕ੍ਰਿਕਟ ਦੇ ਬਦਲੇ ਨਿਯਮ, ਹੁਣ ਇਸ ਕੇਸ ‘ਚ ਦੁਬਾਰਾ ਨਹੀਂ ਮਿਲੇਗੀ ਬੈਟਿੰਗ, ਮੰਨਿਆ ਜਾਵੇਗਾ

- ਸਚਿਨ ਤੇਂਦੁਲਕਰ ਦੇ ਬਰਾਬਰ ਪਹੁੰਚੇ ਜੋ ਰੂਟ, ਪਰ ਵਿਰਾਟ ਦੇ ਇਸ ਰਿਕਾਰਡ ਤੋਂ ਅਜੇ ਵੀ ਦੂਰ

- Ratan tata death: ਸਿਰਫ ਵੋਲਟਾਸ ਹੀ ਨਹੀਂ, ਸਵੇਰ ਤੋਂ ਰਾਤ ਤੱਕ ਤੁਹਾਡਾ ਕੰਮ ਟਾਟਾ ਦੇ ਬਿਨਾਂ ਨਹੀਂ ਚੱਲ ਸਕਦਾ